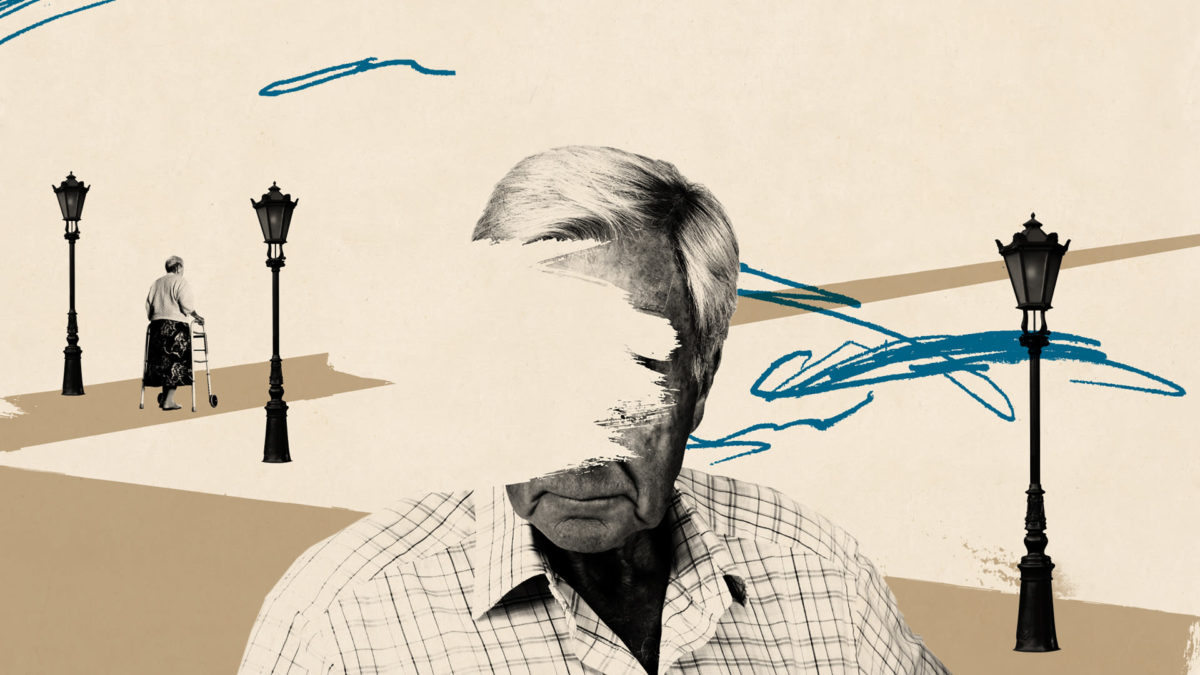

Charles hit 70 years old last week.

After his divorce, he took over the task of managing all the housework in the family. Just like other Californians, Charles likes to enjoy the sun and the little serendipities in his life. So, only three days after his birthday, Charles decided to move into a long-term care home to spend more time enjoying the idleness he deserves.

But here comes a problem: Charles wants to sell his house and use the money to cover his long-term care home expenses. However, his son is still living in his house with him. The cost of long-term care homes in California isn’t cheap, and it hurts Charles when he thinks about kicking his son out of the house as well.

Charles is in a conundrum that many seniors are.

Paying for long term care homes isn’t easy in the US. There are different types of long-term care homes. Here, we talk about nursing homes. According to the statistics from 2018, the average annual cost of a private room in a long-term care home across the US was $106,000. For some major cities, such as in San Francisco, the nursing home rate could reach $182,500 a year, and that’s why so many people choose to sell their property to live in a community.

However, selling houses isn’t the ultimate option to pay for a long-term care home There are, in fact, many benefits you should check out to relieve your financial burden.

How To Pay for A Long-Term Care Home in the US

Government Programs:

Just like in Canada, (Paying For LTC Homes In Canada) there are many government programs for senior citizens to use, and you probably already know of Medicare and Medicaid if you are living in the US.

However, there are some differences in range of what Medicare and Medicaid can cover:

Medicare

Medicare is a federal program that provides health coverage for people who are over 65 or under 65 and with a disability. Note that it only covers the expense of long term care that requires skilled services and rehabilitative care for 100 days, or a short period of time of receiving skilled home health and skilled in-home services.

Medicare works in the following situations:

-

Hospital deductible: the cost after you have paid a certain amount

-

Short stays in a nursing home to receive medical care that arose after a hospitalization

-

Hospice care

-

Outpatient care, doctor visits

-

Some medication costs

Medicaid

Medicaid, on the other hand, is a combined Federal and State program for low-income residents. It is only available to individuals who meet the requirements set forth by their state, and the modified adjusted gross income (MAGI) and the federal poverty line are used to determine financial eligibility for Medicaid.

Medicaid covers the cost of medical care and some long-term care. However, the range it covers may vary state to state, and in most cases, the coverage is very limited. As for California, the Medi-cal program can only cover 30 days of stays and medication in a Skilled Nursing Facility (SNF).

Program of All-inclusive Care for the Elderly (PACE)

While Medicaid can only cover a very limited amount of services and expenses, PACE can cover much more long-term care services (including medical and social services) for senior citizens, and it pays some or all of the long-term care expenses for the patients who have Alzheimer’s disease.

Now, PACE is active in 28 states. For more details, visit: https://www.medicaid.gov/medicaid/long-term-services-supports/pace/programs-all-inclusive-care-elderly-benefits/index.html

Other Programs

There are also many other benefit programs or institutions designed to serve a certain group of individuals. For example, the U.S. Department of Veterans Affairs provides long-term care and at-home care for some veterans and their family. If you wish to know how to use different programs according to your situation, you can consult the National Council on Aging (NCOA). NCOA offers a free service called “BenefitsCheckUp” to screen your eligibility and find you a list of Federal and State benefit programs that can help you and your loved one.

Private Payment Options

If you don’t meet the eligibility to require financial aid from your state, and you wish to explore more options other than paying from your own savings, there are some ways you can try:

Long-Term Care Insurance

This type of insurance is purchased when you are younger. Long-term care insurance covers many long-term care services including palliative and hospice care. The cost depends on the amount of services, age and health condition. Thus, the earlier it is planned, the better it can serve.

Reverse Mortgages for Seniors

A reverse mortgage is a particular type of house loan that allows a homeowner who is over 62 years old to get a portion of their property’s equity in return, so they can use the returned amount to cover their long-term care home.

Reverse mortgages have no criteria for applicant’s income or health, only age (>62). Moreover, the loan amount is tax free and can be used for any expense. However, it’s only useful for a mortgage-free property. So if you already owe money on your house in the form of a mortgage or another type of debt, you must pay it off first to get the benefit.

References:

https://www.nia.nih.gov/health/paying-care

https://health.usnews.com/best-nursing-homes/articles/how-to-pay-for-nursing-home-costs#long