Everyone knows Steve – the toughest and most obstinate man in the long-term care home. It is very difficult to convince him to do anything, which also includes welcoming his grandson’s dog, a three-year-old yellow lab.

“I hate dogs! They are annoying and dirty,” shouted Steve, speaking to his son on FaceTime. “Don’t ever bring that thing here…I won’t even let it in!”

Apparently, Steve’s grandson was even more uncompromising than his grandpa. He still brought the dog to the long-term care home, two weeks after the FaceTime call. His grandson gave: “The dog can’t be left in the house alone.”

The first greeting wasn’t so pleasant. Steve looked at the dog and angrily asked his son why he had brought him. However, the dog wasn’t aware of Steve’s disgust – he put his paw on Steve’s knee and wagged his tail happily, as if he were saying, “Hi Steve, it’s nice to meet you!”

After two hours of visiting, the family decided to go back. “Hey, why don’t you just leave the dog here since you will be in the city for a week,” requested Steve. “You said yourself that the dog can’t be left alone. I think I can take care of him.”

It may have been surprising for a man like Steve to say that, but it did not surprise anyone that day. Everyone witnessed how happy and gentle Steve was when he was playing with the dog and how he made Steve another different person – a person that no one had ever seen.

“Maybe animals are magic,” joked Steve’s caregiver. “They can do the tricks that we can’t.”

This is true – our fluffy friends are amazing. They don’t speak (human languages), and they don’t buy you any gifts (small dead animals and sticks don’t count, of course). However, they have the power to sweep the haze away from your life and let the sunshine in – which is also a primary reason why so many institutions are using pet therapy to cope with people’s health problems.

What Is Pet Therapy?

Pet Therapy is a type of therapy that uses specially trained animals to offer affection and comfort to a community or a single individual. It is being used in a variety of organisations, including hospitals, schools, mental health facilities, and retirement and assisted living homes.

There are three different types of pet therapy: Facility Therapy, Animal-Assisted Therapy, and Therapeutic Visitation.

Facility Therapy refers to having the pets reside at the care home and trained to monitor dementia patients. At the same time, Assisted Therapy means a specific individual owns a trained pet in the assisted living community and receives a more intensive treatment.

Therapeutic Visitation, on the other hand, is the most common type of pet therapy out of the three. It refers to pet owners bringing their pet and visiting long-term, care homes, which allows seniors to spend time with them and enjoy their companionship without having to take on the additional responsibility of caring for them all the time.

Why Do We Love Pet Therapy?

-

Encourages Social Engagement

It may be awkward if two strangers stand together, but if there is a pet sitting around them, the two individuals are more likely to interact with each other. Isn’t that amazing? In many cases, pets serve as excellent conversation starters. Residents can connect with each other and form new friendships when they spend time with animals.

-

Pet Therapy Has Many Physical Benefits

Did you feel amused when you scroll through TikTok and see pet videos? If yes, you’ve already benefited from “The Pet Effect”.

The term “The Pet Effect” refers to the miraculous healing powers of watching or interacting with pets. Spending time with dogs has been found in studies to lessen long-term care home residents’ pulse rates, as well as their stress and anxiety levels, as well as their heart rate and blood pressure.Some parents notice that their children who have depression will show alleviation in their symptoms when they have pets around, and it works for seniors, too. After all, these little animals don’t judge or give you any advice, and stay with you no matter what you do.

-

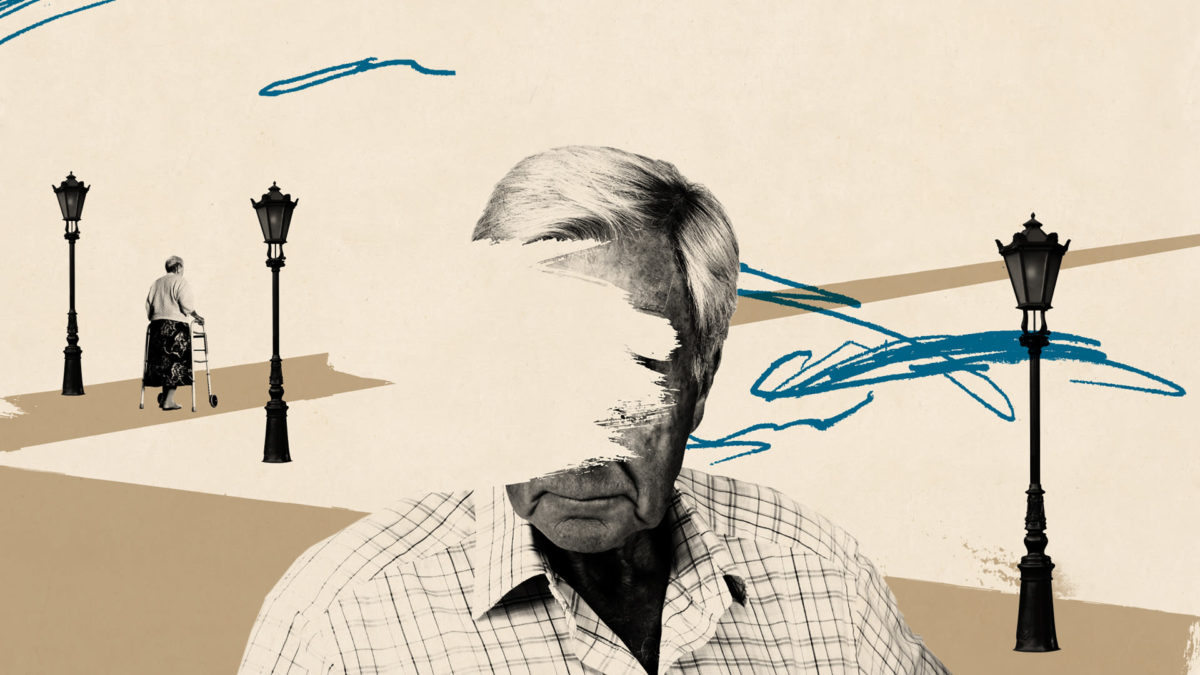

Senior isolation

If you have subscribed to our page, you must be familiar with the term “Senior Isolation”. Many seniors tend to have feelings of loneliness and isolation, either as a result of a lack of frequent visits from family and friends, a loss of a significant other, or a decreased level of physical activity.

Senior Isolation is difficult to tackle because so many seniors are “comfortable” in their unhealthy settings. So, for the reluctant elders, we can use our paw-friends to bring them out of their “shells”, and thus make them more open to new friendships. Feel free to check out our blog on “Senior Isolation”we have a lot of advice for you to help your loved one if he or she is experiencing loneliness.

Who Can be Our Paw-Friend?

Not all pets can be used in pet therapy, given the various personalities among the species and breeds. Normally speaking, old dogs and indoor cats are more suitable for companionship and providing comfort for seniors – they are quiet and understanding (yes, they are more sensitive to human’s needs when they get older).

There Are Limitations:

Just like many medications, pet therapy is not without its limitations. The more prominent concern of pet therapy would be safety. Many long-term care homes will ensure the animals are well-trained by doing behaviour checks. Cause, some pets may cause a threat to seniors’ safety if they are not properly trained.

Another issue is sanitation. Seniors tend to have compromised immune systems. Any unvaccinated or unwashed animals may cause allergies or infections among senior residents.

References:

https://www.mayoclinic.org/healthy-lifestyle/consumer-health/in-depth/pet-therapy/art-20046342